Our 2026 Outlook

January 2026

As we step into 2026, we recognize that the coming year brings both uncertainties in the market and plenty of potential. Perfectly predicting the next 12 months is impossible, but looking ahead, we continue to identify areas where we can control the controllable, adapt to legislative changes, and continue to serve our clients’ best interests.

In that spirit, we’ve gathered insights from leaders across our organization to share the priorities, trends, and strategies they’re considering as we begin this new chapter. We’ve also gathered market outlooks from across the industry and identified some key limits, rates, and guidelines for individuals and institutions.

Kevin Karpuk, CEO: “2026 marks a couple of important anniversaries. On the national level the United States turn 250 years old. On a smaller level Cornerstone celebrates our 10th anniversary of being an ESOP company. We are incredibly excited about the possibilities ahead. Organizations that are not growing and innovating are dying, but any group that forgets its origin story is subject to the random winds of the times. We are as committed as ever to the belief that our independence and risk-focused strategies will continue to serve our clients.”

Ryan Wood, Co-Chief Investment Officer: “After three years of extraordinary market returns, it’s easy to be lulled into a sense of complacency and the temptation to up-risk a portfolio. As we look ahead to our 2026 Capital Market Assumptions, we focus on the real year-to-year differences between portfolio allocations and their associated downside risks. This annual exercise is meant to curb behavioral biases–whether it’s the temptation of risk after years of strong returns or the aversion to it after large pullbacks.”

Trevor Reid, Co-Chief Investment Officer: “Innovation and investment in artificial intelligence is here to stay. And just like innovation, AI investment will continue to change and adapt. The model builders led the charge, followed by the chip designers and chip makers, then the hyperscalers and energy providers. What does the next phase of the investment wave look like? Does the market’s attention turn to the implementors? Who will be able to best utilize AI and gain an edge before everyone else? Will its implementation be used more for cost control or will it be able to create and generate new revenue streams? These questions are not easy to answer nor will it be easy to pick winners, but it is important to understand the dynamics and stay in the game.”

As part of our preparation for our 2026 Capital Market Assumptions, we’ve compiled market outlooks from firms across the industry. Here are some common sentiments, key themes, and trends we have identified:

-

Continued moderate domestic economic growth amidst a backdrop of easing monetary policy and supportive fiscal policy.

-

Opportunities in both emerging and developed international markets, driven by modest global growth coupled with a softer US dollar associated with global monetary policy differentials.

-

AI as a continued major market force. Notably, firms caution against overconcentration and cite the importance of active selection.

-

Investment grade credit as the linchpin of fixed income. Private credit presents an opportunity, but the binary nature of outcomes and the dispersion of returns between issuers again emphasizes the importance of due diligence.

-

Inflation remains a potential risk, encouraging investments in real assets, commodities, and infrastructure.

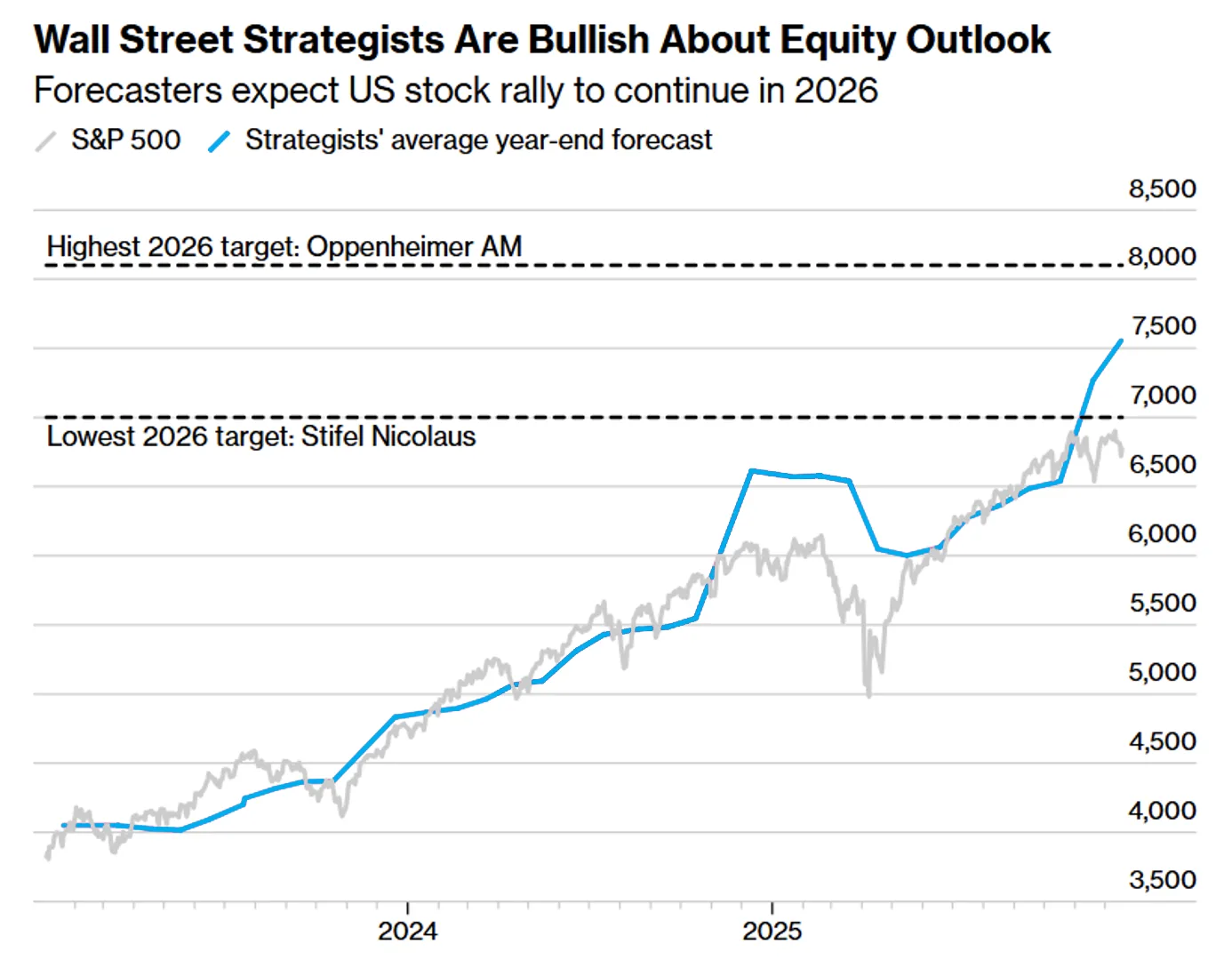

Overall, the trend we see in the market is bullish for 2026, although firms acknowledge that risks still loom. The chart below indicates just how much consensus exists across firms. Mid-single digit returns from the stock market after such a strong run seems reasonable to us, but our experience tells us that too much consensus can lead to blind spots and surprises. As a firm focused on risk management, we continue to exhort prudence and sound processes when developing portfolios. We look forward to providing more details on our longer-term outlook while reviewing our Capital Market Assumptions with you in the near future.

Source: Bloomberg – Every Wall Street Analyst Now Predicts a Stock Rally in 2026

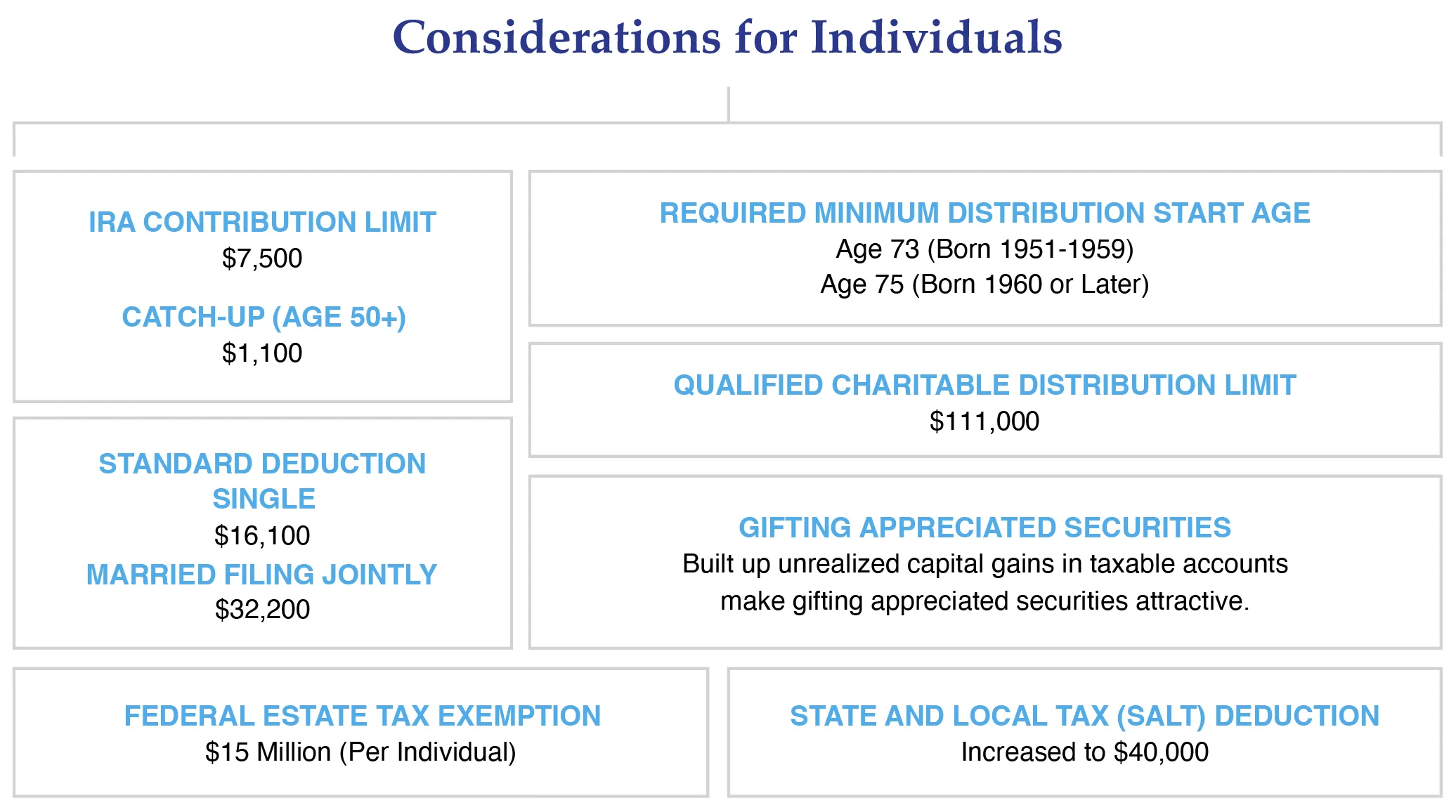

Tyler Papaz, President and Director of Private Wealth: “For private wealth clients, the OBBB locks in or expands a number of tax provisions that impact estate-, charitable-, and small business- planning strategies. For example, a permanently higher gift- and estate- tax exemption of $15 million per individual (indexed to inflation) removes the “use it or lose it” timing pressure of the exemption created under the 2017 Tax Cuts and Jobs Act, providing clarity to individuals establishing their estate planning strategies.”

Angela Oste, Director of Insurance Operations: “The OBBB doubles the federal estate tax exemption, which may result in fewer estates leveraging life insurance as a liquidity tool for estate tax payments. However, higher standard deductions and senior-focused tax breaks may free up cash flow for premium funding or charitable planning using life insurance. Life insurance continues to be relevant component of estate planning as a source of tax-free funds that can replace lost income, carry out a buy-sell, equalize inheritances if some children will not inherit a business, and provide for other survivor needs.”

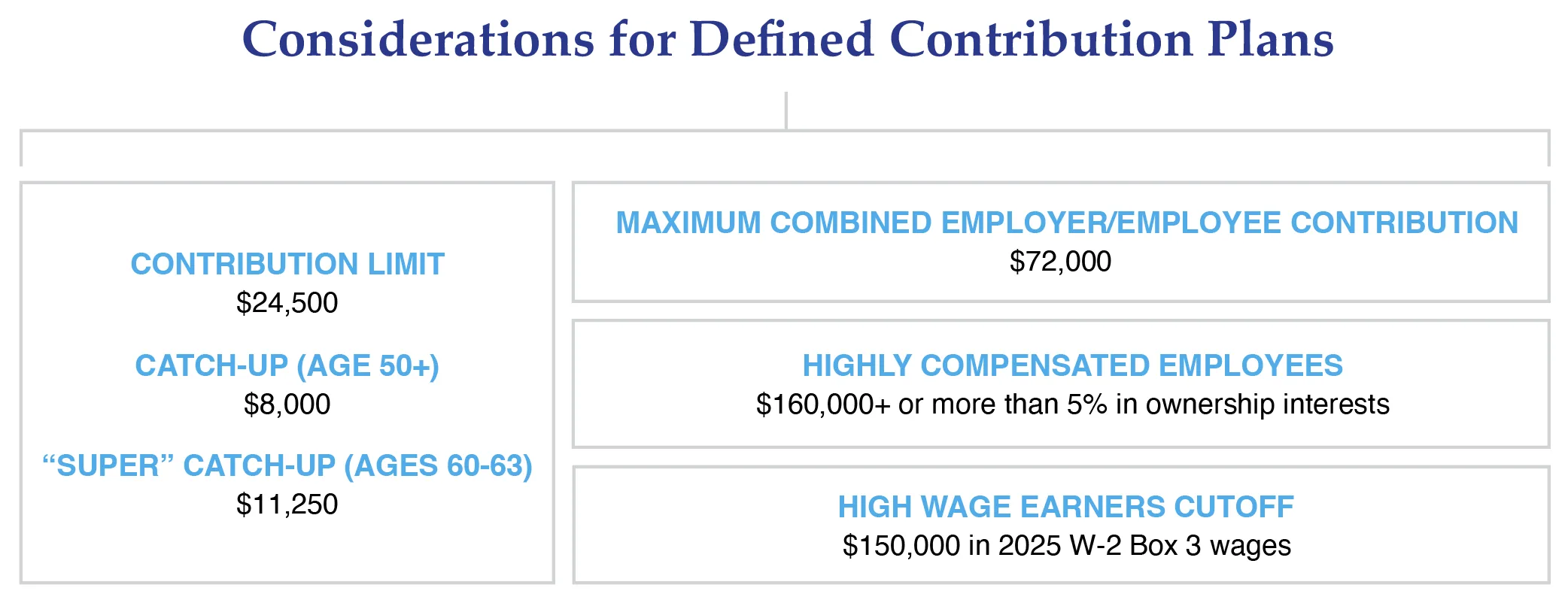

Jennifer Bauder, Director of Retirement Planning: “2026 comes with several critical deadlines for retirement plans. Full document restatements incorporating required and provisionally adopted features from SECURE, CARES, and SECURE 2.0 are due by the end of the year for most plans. One of the most discussed provisions is the requirement for catch-up contributions made by high wage earners to be Roth (pre-tax) contributions, effective at the start of the year. A robust communication campaign explaining changes to participants has already begun and will continue throughout 2026. It will be interesting to see what, if any, retirement savings behaviors change based on new policy.”

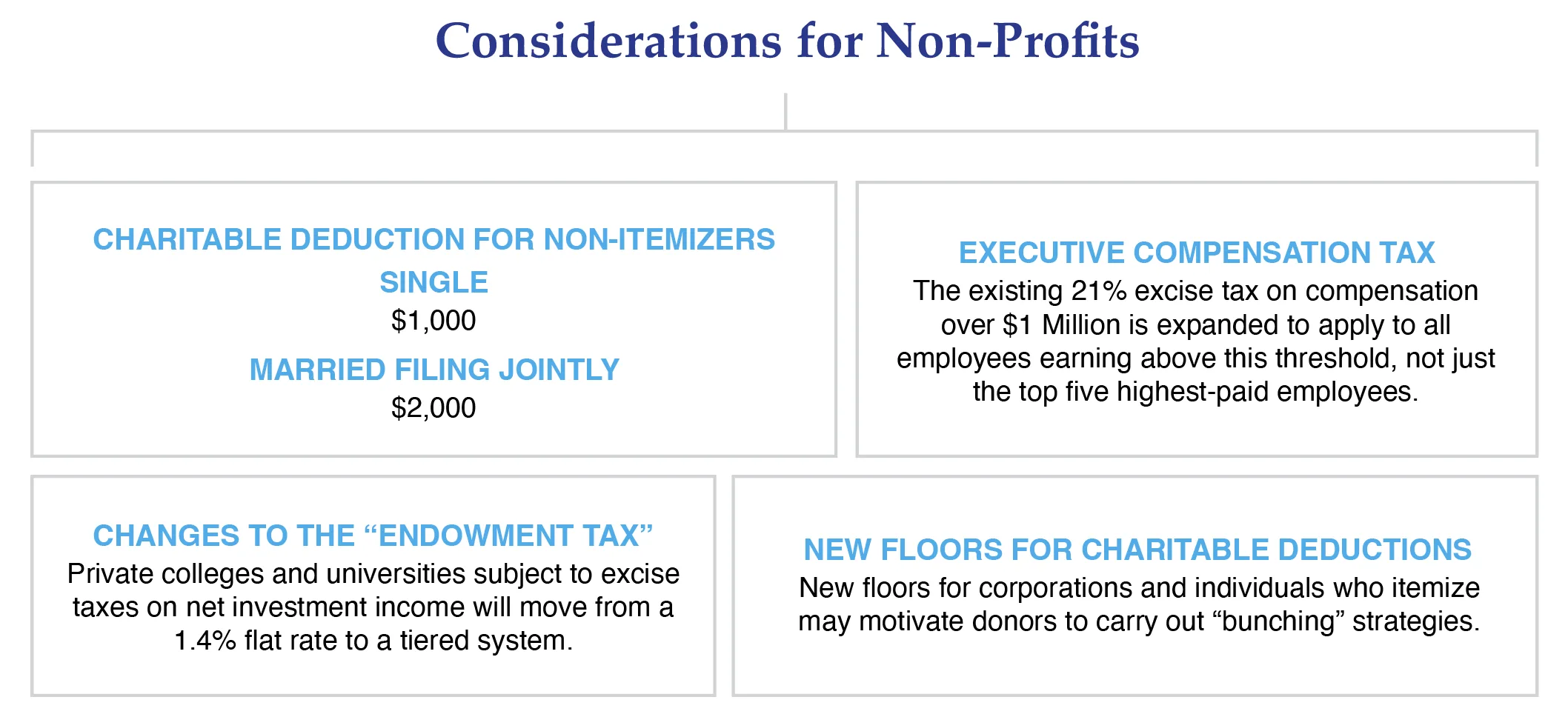

Stephen Link, Director of Philanthropic Services: “The operating environment for many non-profits has become more difficult. Uncertainty around government funding, reimbursements, and pricing for services, as well as inflationary cost pressures and increased competition for philanthropic support, are creating strong headwinds for many institutions. A less discussed, longer-term challenge for non-profits is defining their value proposition to those making generational wealth transfer decisions. Policy changes around estate taxes have reduced the inducement to consider charitable donations, so institutions will need to refine their message as potential donors assess their approaches to asset distribution during retirement and at death.”

In closing, we would like to thank our clients for their continued trust in Cornerstone. It is an honor to serve each and every one of you, and we wish you all a very happy new year.

Commentary regarding the returns for investment indices and categories do not reflect the performance of Cornerstone Advisors Asset Management, LLC / Cornerstone Institutional Investors, LLC, or its clients. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results. Figures contained herein are obtained from sources deemed reliable, but we do not guarantee its accuracy or completeness. Past performance is no guarantee of future results. Investments fluctuate in value.

Securities offered through M Holdings Securities, Inc., a Registered Broker/Dealer, Member FINRA/SIPC. Investment Advisory Services are offered through Cornerstone Advisors Asset Management, LLC. Cornerstone Advisors Asset Management, LLC and Cornerstone Institutional Investors, LLC are independently owned and operated. 5124769